The new pension agreement: Honest and controlled business management

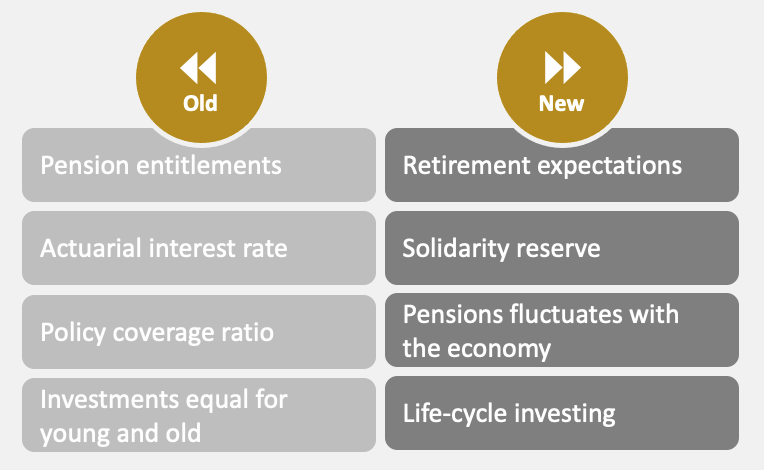

After negotiations lasting for years, the Dutch government and representatives of employee and employer organisations have reached an agreement on a new pension system. Transparency and making pensions more personal are central to this new system. The figure below shows the main changes compared to the old system. These reforms require a great deal of adaptability. Pension funds, pension implementation organisations, and other pension providers are facing a major transformation process.

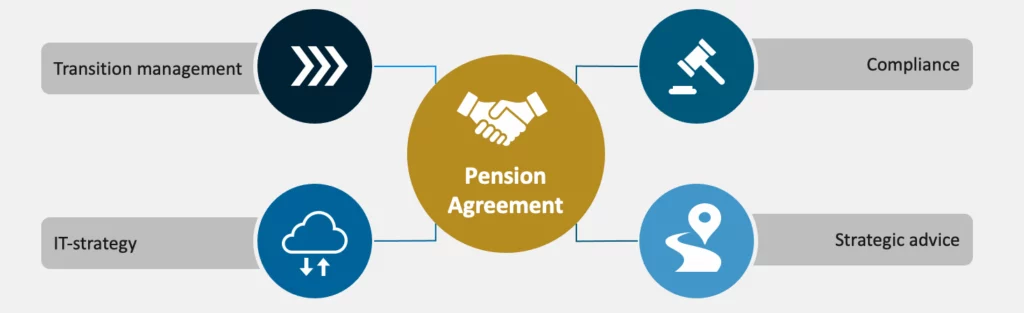

Currently, the preliminary agreement is being developed into a bill, so the concrete implementation is not yet known. However, it is known that the transition period has started from January 1, 2022, and by January 1, 2026, all pension funds and pension providers must comply with the new rules. Pensions & Insurance can contribute to the honest and controlled transition to the new pension system in various areas.

A controlled and honest transition to the new pension scheme is of great importance. We would be happy to take care of this (complex) transition by carrying out transition management or implementing the new pension scheme. We do this based on the frameworks of regulators and our experience in carrying out transitions and implementations.

The new pension system and the transition to it have a huge impact on IT. New pension schemes need to be executed and new pension products offered. Therefore, the transition to the new system requires a new IT strategy. We can guide organisations in defining and implementing the IT strategy.

In the coming years, the new pension system will be further developed in bills. The pension scheme(s) must comply with this new legislation and regulations. We can translate the new legislation and regulations into standards, principles, and policy documents, and also advise on the extent to which the new pension scheme complies with the legal frameworks.

The transition to the new pension system involves a number of significant changes. We can identify the milestones that lie ahead and define different solutions for each milestone. In addition, we can map out which stakeholders need to be involved for each milestone, so that you can make well-considered and timely decisions with your stakeholders.

Our project managers can provide guidance in various areas, so that the changes resulting from the new pension system are implemented in a structured way within your organisation.

Established in 2006, Projective Group is a leading Financial Services change specialist. With deep expertise across practices in Data, Payments, Transformation and Risk & Compliance.

We are recognised within the industry as a complete solutions provider, partnering with clients in Financial Services to provide resolutions that are both holistic and pragmatic. We have evolved to become a trusted partner for companies that want to thrive and prosper in an ever-changing Financial Services landscape.