Unravelling Financial Intricacies: Iran’s Alleged Sanctions Evasion Through Major UK Banks

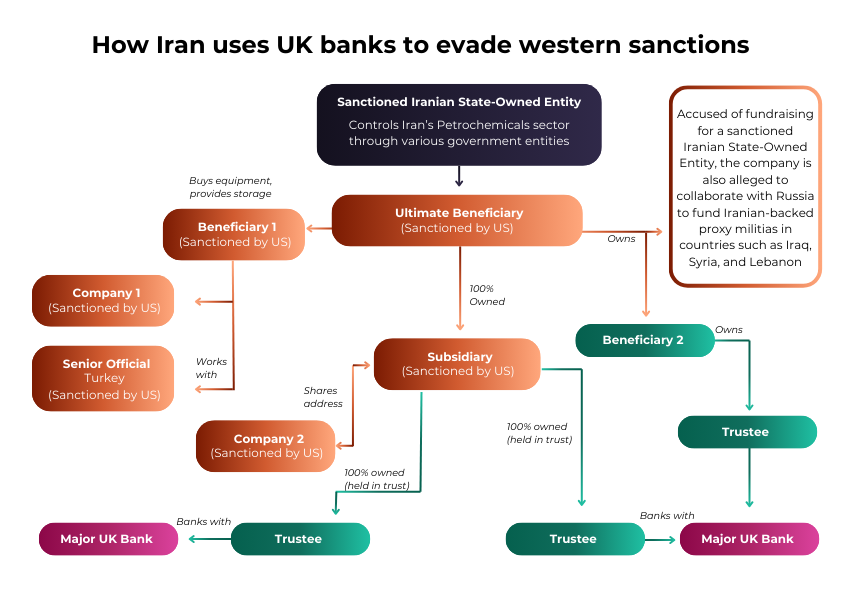

Recent reports from the Financial Times and numerous other credible sources have brought to light a concerning revelation about Iran’s evasion of sanctions, allegedly facilitated through Trustee accounts at two UK banks. The report suggests that the company orchestrated its financial activities through front entities in China, concealing ownership through trustee agreements and nominee directors in the UK. This intricate network facilitated the global movement of funds, all while circumventing the stringent sanctions imposed on Iran. Projective Group unravels this intriguing story.

The financial institutions implicated in these allegations, referred to as bank A and bank B, declined to comment on individual customers, a stance that echoed the inherent confidentiality of banking relationships. However, one bank took the opportunity to assert its compliance with US sanctions, emphasizing its commitment to regulatory adherence and proactive engagement with relevant authorities. The other, after conducting a full exposure check, maintained that its business activities were in strict adherence to applicable sanctions laws.

The banks reportedly offered accounts to two holding companies, Aria Associates and Pisco UK. Aria Associates, associated with PCC, allegedly held an account with bank A, while Pisco UK, reportedly had an account with bank B. The implicated businesses are said to be fully owned by PCC UK, although independent confirmation is pending.

While the report caused a notable dip in bank A’s shares, analysts suggest that the impact on Bank B might not translate into significant financial risk. Bank B, with robust CET1 and strong profitability, is seen as resilient to these accusations.

At a broader level, the timing of these allegations is significant, coinciding with the imposition of additional sanctions by the United States on Iran’s missile and drone programs. The involvement of two UK banks in such activities raises concerns about the effectiveness of existing financial regulatory measures.

In a situation like this, it is recommended to mitigate risks associated with potential breaches of sanctions and to enhance the effectiveness of KYC (Know Your Customer) processes. Implementing or strengthening a combination of the following list can significantly reduce the risk of breaching sanctions and enhance the overall effectiveness of KYC monitoring in the financial sector.

Preventing a situation like this might sound easy, but it is far from it. Any organisation will need comprehensive expertise in addressing a spectrum of financial crime challenges across key pillars including:

KYC processes involve a number of manual, repetitive steps that demand significant time and resources, positioning it as an ideal candidate for automation through AL and ML. Yet, it is difficult to create the right automation for the right key pillar. Projective Group’s AI-driven capabilities can help banks automate the various stages and checks that are currently traversed manually in existing KYC procedures.

Concluding this serious discourse on alleged sanctions evasion, the gravity of the situation underscored the challenges inherent in enforcing financial regulations globally. The intricate financial manoeuvres executed by sanctioned entities emphasized the need for continual scrutiny and reinforcement of regulatory frameworks. Inviting a third-party in with deep understanding of regulatory landscapes and a proven track record in implementing robust compliance framework, might just offer the tailored solution banks are looking for.

Established in 2006, Projective Group is a leading Financial Services change specialist.

We are recognised within the industry as a complete solutions provider, partnering with clients in Financial Services to provide resolutions that are both holistic and pragmatic. We have evolved to become a trusted partner for companies that want to thrive and prosper in an ever-changing Financial Services landscape.