All eyes on CSRD, but what about Taxonomy Regulation?

Not by exception news flashes, blogs and podcasts point out the new ESG buzzword: Corporate Sustainability Reporting Directive, in short CSRD.

Understandable, as it takes quite some effort to prepare your organization for such a transformation. But what about other ESG requirements, that go hand in hand with CSRD? If you change the perspective of CSRD requirements another important topic of ESG comes to light: Taxonomy Regulation, in short TR. New requirements? No, not in particular. But more intense for companies in scope of CSRD? Definitely.

Why? Let’s explain by an example.

Imagine you are an asset manager in scope of CSRD. When preparing the Sustainability Statement under CSRD, you come across an interlinkage of CSRD and TR by reading already the first (of 12!) European Sustainability Reporting Standard, ESRS. ESRS 1 includes the general requirements for the Sustainability Statement.

In this ESRS it is explained that the Sustainability Statement shall include the disclosures pursuant to Article 8 TR – and accompanying Delegated Regulations- that specify the content and other modalities of those disclosures. Moreover, it is explained that these disclosures must be separately identifiable within this statement. And more specific, the disclosures relating to each of the environmental objectives defined in the TR must be presented together in a clearly identifiable part of the environmental section of the Sustainability Statement.

So, the order of the Sustainability Statement under CSRD should consist of 4 parts:

1. general information,

2. environmental information including disclosures pursuant to Article 8 of TR,

3. social information and

4. governance information.

What needs this asset manager to disclose under the Taxonomy Regulation and therefore needs to be added to the Sustainability Statement?

Let’s have a look.

Article 8 TR applies to both financial undertakings (like this asset manager but also for example credit institutions or insurance companies) and non-financial undertakings that are in scope of CSRD. It consists of different key performance indicators and forms of disclosure depending on whether you are a non-financial or financial undertaking. For financial undertakings disclosure requirements depend on the type of financial undertaking at hand. In this case the KPI’s and forms specific for an asset manager should be followed (several Annexes).

Implementation of Article 8 TR requirements was divided over two phases. Phase 1 required financial undertakings to disclose to what extent its activities were taxonomy-eligible and non-eligible in calendar year 2022 and 2023. As of calendar year 2024, financial undertakings are required to disclose the total amount of taxonomy aligned activities versus its non-taxonomy aligned activities.

So as of 2024 our asset manager is required by article 8 TR to include information in their Sustainability Statement on how and to what extent its activities are TR-aligned. What is the difference of taxonomy eligible, and taxonomy aligned activities? Is the wording so significant? Yes, it is.

‘Taxonomy-eligible’ means an economic activity that meets the Technical Screening criteria of the 6 climate goals:

irrespective of whether that economic activity meets any or all of the technical screening criteria.

Taxonomy alignment requires full compliance with all aspects of the TR including all technical screening criteria.

Where our asset manager needed to disclose only eligibility of its investments on – for example – climate change mitigation as of now it needs to assess the taxonomy alignment of these investments for its Sustainability Statement.

Let’s explain a bit more.

Currently for climate change mitigation nine main topics are listed as taxonomy eligible. Each main topic is further specified into numerous subtopics. A main topic is – for example – activity 7 construction and real estate. Listed subtopics are:

Our asset manager reported its real estate investments as taxonomy eligible as all of these investments are covered by activity 1. the construction of new buildings.

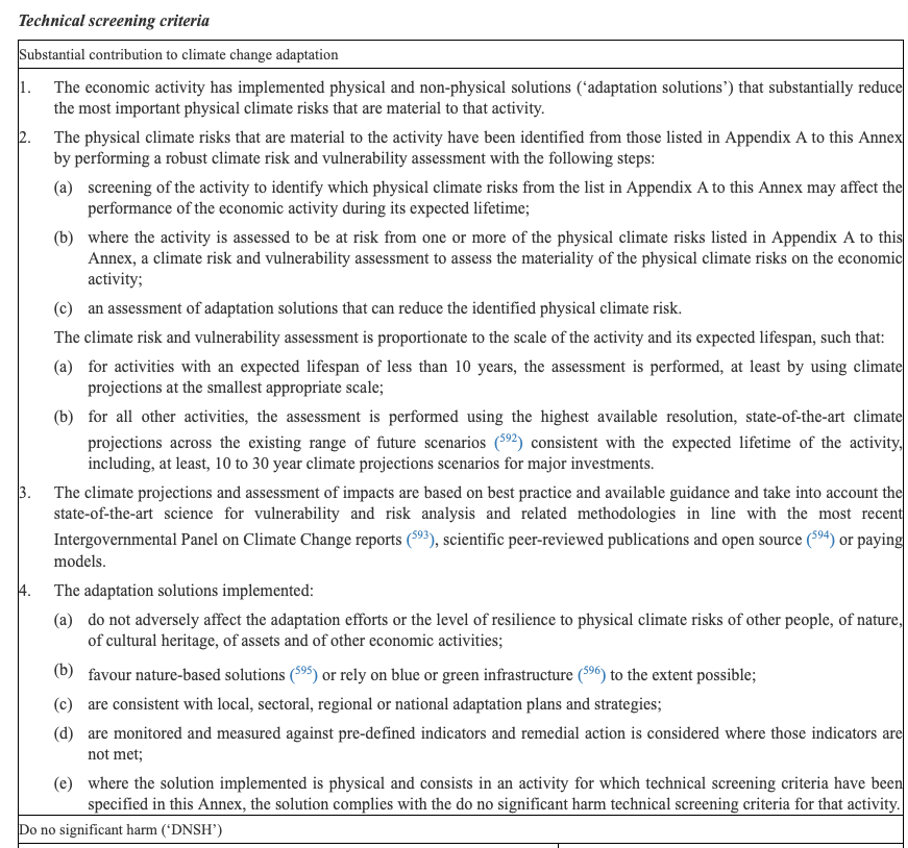

In order to establish taxonomy-alignment, our asset manager should check if these investments meet all the technical screening criteria of activity 1. Below is a simplified and random representation of some of these criteria to give you an idea.

To do so our asset manager should not only check whether these activities are compliant with all technical screening criteria, but also if the documents/information provided by companies they invest in are adequate and evidence that the investments indeed are Taxonomy aligned.

In other words, taxonomy alignment raises the bar substantially for this asset manager in comparison to previous years and could lead activities formerly reported as “taxonomy eligible” are no longer allowed to report as such and will need to be adjusted into “non-taxonomy aligned” as the activity does not meet all the technical screening criteria.

Our advice? Be prepared and don’t run the risk of putting all your efforts on CSRD and forgetting about TR, equally important as CSRD but not being so much of a buzz ESG word yet.